Yes! You can use AI to fill out Form 4506-T, Request for Transcript

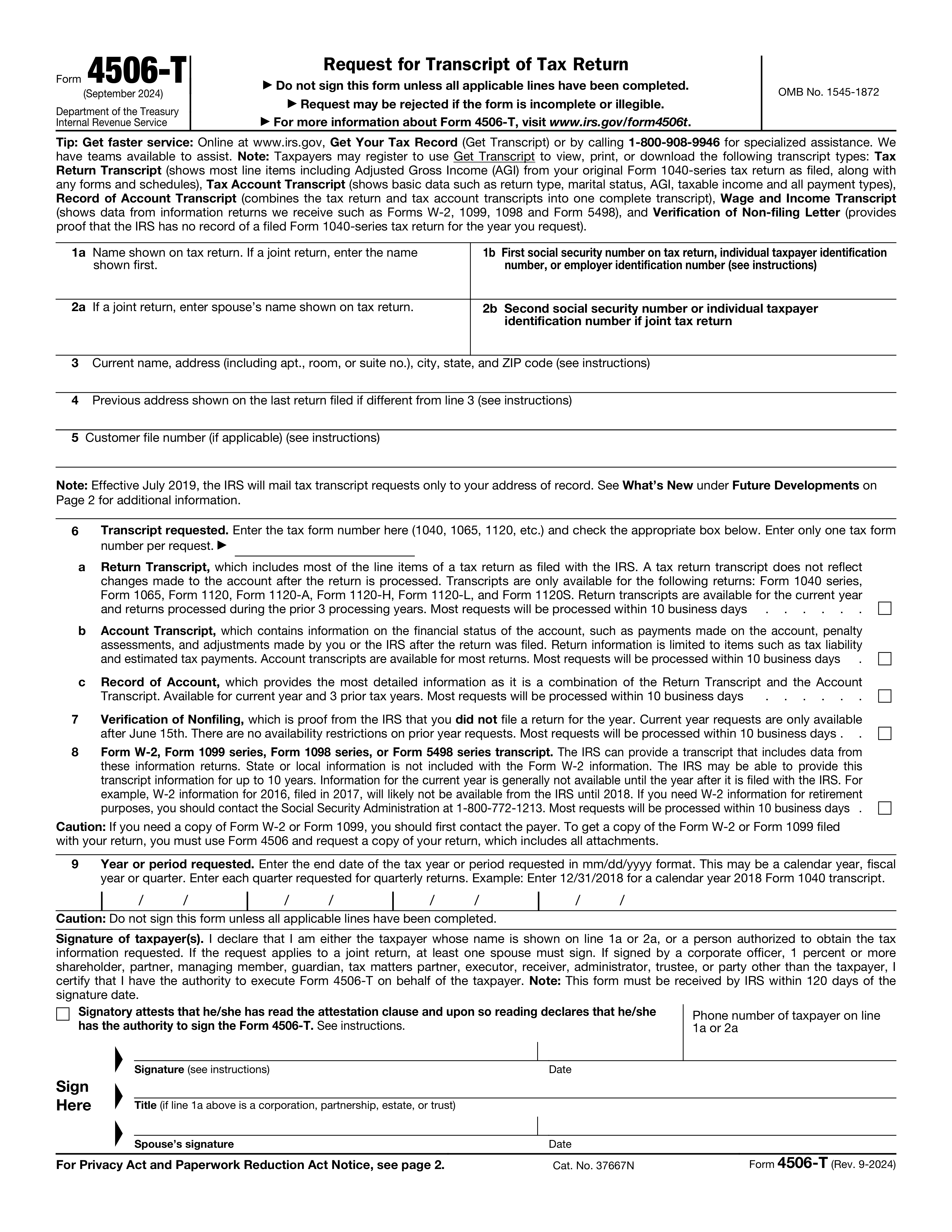

Form 4506-T, officially titled 'Request for Transcript of Tax Return', is used to request tax return transcripts, tax account information, record of account, W-2 information, and verification of non-filing from the IRS. It is important for verifying past income and tax filing status for loans, mortgages, or college financial aid.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out 4506-T using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Form 4506-T, Request for Transcript |

| Form issued by: | Internal Revenue Service |

| Number of fields: | 28 |

| Number of pages: | 2 |

| Version: | 2023 |

| Form page: | https://www.irs.gov/forms-pubs/about-form-4506-t |

| Official download URL: | https://www.irs.gov/pub/irs-pdf/f4506t.pdf |

| Language: | English |

Instafill Demo: filling out a legal form in seconds

How to Fill Out 4506-T Online for Free in 2025

Are you looking to fill out a 4506-T form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2025, allowing you to complete your 4506-T form in just 37 seconds or less.

Follow these steps to fill out your 4506-T form online using Instafill.ai:

- 1 Visit instafill.ai and select 4506-T

- 2 Enter name as shown on tax return

- 3 Input SSN, ITIN, or EIN as applicable

- 4 Provide current and previous address

- 5 Specify transcript type and tax form number

- 6 Indicate year or period requested

- 7 Sign and date the form electronically

- 8 Check for accuracy and submit form

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable 4506-T Form?

Speed

Complete your 4506-T in as little as 37 seconds.

Up-to-Date

Always use the latest 2025 4506-T form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form 4506-T

Form 4506-T, Request for Transcript of Tax Return, is used to request tax return information from the IRS. It allows individuals and businesses to obtain various types of tax transcripts, including tax account transcripts, wage and income transcripts, record of account transcripts, and verification of non-filing. These transcripts are often needed for mortgage applications, student or small business loan applications, and for tax preparation or filing.

To get faster service than mailing Form 4506-T, you can use the IRS's online tool, the 'Get Transcript' service, which allows you to view and download your transcript immediately. Alternatively, you can also call the IRS to request a transcript, which may be faster than mailing the form. For businesses and individuals who need transcripts for income verification, the Income Verification Express Service (IVES) is available, which provides expedited processing.

Using Form 4506-T, you can request the following types of transcripts: Tax Return Transcript (shows most line items from your tax return as filed), Tax Account Transcript (shows basic data such as return type, marital status, adjusted gross income, taxable income), Record of Account Transcript (combines the information from a tax return transcript and a tax account transcript), Wage and Income Transcript (shows data from information returns reported to the IRS, such as W-2s, 1099s, and 1098s), and Verification of Non-filing Letter (provides proof that the IRS has no record of a filed tax return for the year requested).

On Form 4506-T, you need to provide the following information: your name, address, and Social Security number or employer identification number; the name and Social Security number of your spouse if filing jointly; the address on your latest tax return; the form number of the tax return you are requesting; the tax years you are requesting transcripts for; and a third-party name and address if you want the transcript sent directly to a third party, such as a mortgage company. You also need to sign and date the form, giving the IRS permission to release your tax information.

Requests made with Form 4506-T are typically processed within 10 business days. However, the processing time can vary depending on the method of delivery chosen and the IRS's current workload. If you use the online 'Get Transcript' service, you may be able to receive your transcript immediately. If you mail the form or use the IVES program for expedited service, it may take longer. It's important to plan accordingly if you need the transcript by a specific date.

Yes, you can request a tax return transcript for a return from more than three years ago using Form 4506-T. However, the IRS generally only keeps tax return transcripts for the current tax year and the three prior tax years. If you need information from older tax years, you may need to order a copy of your actual tax return using Form 4506, Request for Copy of Tax Return, which may involve a fee.

If your address has changed since the last tax return you filed, you should provide your new address in Section 3 of Form 4506-T. Additionally, if you want the transcript sent directly to a third party, you can enter their address in Section 5. It's important to keep your address current with the IRS to ensure you receive any correspondence or transcripts. You can also update your address with the IRS by filing Form 8822, Change of Address.

The Customer File Number is an optional field on Form 4506-T where you can enter a unique identifier that you create to help you match the transcript to the taxpayer. This number will appear on the transcript when it is sent to you and can be up to 10 numeric characters. It is especially useful for third parties or businesses that are requesting transcripts for multiple clients or taxpayers.

Submitting false or fraudulent information on Form 4506-T can lead to serious consequences, including penalties, fines, and potential criminal prosecution. The IRS treats such matters with great seriousness as it pertains to the integrity of the tax system. It is important to provide accurate and truthful information when completing and submitting any IRS form.

Form 4506-T must be signed by the taxpayer or a person duly authorized to act on the taxpayer's behalf. If you are requesting a joint tax return transcript, either spouse may sign the form. If you are not the taxpayer but are authorized to obtain the transcript, you must have a completed Form 2848, Power of Attorney and Declaration of Representative, on file with the IRS. For entities other than individuals, such as corporations or trusts, an officer or individual with the authority to bind the entity must sign the form.

Form 4506-T, Request for Transcript of Tax Return, does not have a specific deadline for submission. It can be filed anytime when an individual or business needs to request a transcript of their tax return. However, it is important to submit the form well in advance of when the transcript is needed, as it can take the IRS up to 10 business days to process the request after it is received. For specific deadlines related to tax or loan applications, you should consult the relevant agency or financial institution requiring the transcript.

Yes, either spouse can request a transcript for a joint tax return using Form 4506-T. When filing the form, the requesting spouse must provide the necessary information as it appeared on the original tax return. If the transcript is being sent to a third party, both spouses may be required to sign the form to authorize the release, depending on the state law and the type of transcript requested.

To become an Income Verification Express Service (IVES) participant and receive transcripts, you must apply to the IRS and meet certain requirements. The application process includes submitting Form 13803, Application to Participate in the Income Verification Express Service (IVES) Program, agreeing to the terms of the program, passing a suitability check, and paying a user fee. IVES participants are typically mortgage lenders, banks, or other financial institutions that need to verify a borrower's income. More information about the application process and requirements can be found on the IRS website or by contacting the IRS directly.

If you need a copy of Form W-2 or Form 1099, you should first request them from the employer or issuer of the form. If you are unable to obtain the forms from the issuer, you can use Form 4506-T to request a wage and income transcript from the IRS, which includes information from these forms. However, if you need an actual copy of a Form W-2, you must file Form 4506, Request for Copy of Tax Return, and pay a fee. Note that the IRS only retains actual copies of Form W-2 for a certain number of years.

The mailing or faxing address for Form 4506-T depends on the state in which you live and whether you are requesting the transcript for personal or business taxes. The IRS provides a list of addresses and fax numbers in the instructions for Form 4506-T, which can be found on the IRS website. It is important to send the form to the correct address or fax number to avoid delays in processing your request.

A Return Transcript is a document that includes most of the line items from your original tax return as filed, along with any forms and schedules. It does not reflect any changes made after the return was filed. An Account Transcript, on the other hand, provides more detailed information about the tax account, such as payments, penalty assessments, and adjustments made by you or the IRS after the original return was filed. It provides a record of account activity, including the financial status of the account, such as balances owed or refunds due.

Yes, Form 4506-T can be used to request a transcript for a business tax return. The form allows individuals, corporations, and partnerships to request transcripts of various tax documents, including those related to business tax returns. It is important to provide the correct business name, Employer Identification Number (EIN), and the specific tax form number when making the request.

The signature and date section on Form 4506-T serves as a certification that the person signing the form is authorized to request the information and that they have attested to the truthfulness of the information provided on the form. It is a legal attestation that the requester is the taxpayer or a person authorized by the taxpayer to obtain the information. The date is also required to ensure that the request is current and to establish the timeframe for the IRS to fulfill the request.

To ensure that your Form 4506-T will be processed, you should complete the form accurately and provide all the required information, including your full name, Social Security Number (SSN) or Employer Identification Number (EIN), address, and the tax form number you are requesting. Additionally, you must sign and date the form, and if you are requesting the information for a joint return, both spouses must sign if required. Make sure to check the appropriate box for the type of transcript you need and follow the instructions carefully. Submitting an incomplete or incorrectly filled form may result in delays or denial of the request.

The information provided on Form 4506-T is routinely used by the IRS to process the request for a tax transcript. It can be used to verify past income and tax filing status for loan applications, student or small business loan applications, housing assistance, or for other reasons where proof of income or tax compliance is necessary. The IRS may also share the information with state tax authorities or as otherwise authorized by law. The specific uses are outlined in the instructions and under the Privacy Act and Paperwork Reduction Act Notice of the form.

Compliance 4506-T

Validation Checks by Instafill.ai

1

Name Match on Line 1a

Ensures that the name provided on line 1a of Form 4506-T accurately matches the name listed on the tax return. In cases of a joint return, the software confirms that the name appearing first on the tax return is the one entered on the form. This validation is crucial to maintain consistency and avoid processing errors due to name discrepancies.

2

SSN, ITIN, or EIN Verification on Line 1b

Confirms that the Social Security Number (SSN), Individual Taxpayer Identification Number (ITIN), or Employer Identification Number (EIN) entered on line 1b is the first number listed on the associated tax return. This check is essential to ensure that the tax transcript request is linked to the correct taxpayer's records.

3

Spouse's Name Accuracy on Line 2a

Verifies that the spouse's name is correctly entered on line 2a when filing a joint return. This step is important for the accurate processing of the transcript request, especially when the transcript is needed for both individuals on a joint return.

4

Second SSN or ITIN on Line 2b

Checks that the second Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) is provided on line 2b for a joint tax return. This validation ensures that both taxpayers' identities are correctly associated with the joint tax return for which the transcript is being requested.

5

Current Address Completeness on Line 3

Validates that the current address entered on line 3 is complete and includes all necessary details such as apartment, room, or suite number, along with the city, state, and ZIP code. This check is vital to ensure that the transcript is sent to the correct address and to prevent delays or misdelivery.

6

Address Comparison with Last Filed Return

The AI ensures that the current address provided on Form 4506-T matches the address from the last filed tax return. If there is a discrepancy, the AI confirms that the previous address is correctly entered on line 4. This step is crucial to maintain consistency with IRS records and to prevent any processing delays due to address mismatches.

7

Customer File Number Validation

The AI confirms that the customer file number, if applicable, is entered on line 5 of Form 4506-T. It verifies that the number contains up to 10 numeric characters and does not include the Social Security Number (SSN). This validation is important to ensure that the IRS can accurately associate the transcript request with the correct customer file.

8

Correct Tax Form Number Entry

The AI ensures that the correct tax form number is entered on line 6 of Form 4506-T. Additionally, it checks that the appropriate box for the type of transcript needed is marked. This step is essential to ensure that the requestor receives the correct transcript type for their needs, whether it be a tax return transcript, record of account, or other.

9

Verification of Information Request for Specific Forms

The AI verifies that the correct box is checked on line 8 of Form 4506-T when the requestor needs information from forms W-2, 1099, 1098, or 5498. This validation ensures that the IRS includes the necessary wage and income information with the transcript, which is often required for loan applications and for verifying income.

10

Year or Period Request Format Check

The AI checks that the year or period requested on line 9 of Form 4506-T is specified in the correct mm/dd/yyyy format. This validation is critical to prevent any confusion or errors in processing the request, as the IRS requires specific date formats for accurate record retrieval.

11

Ensures that the taxpayer(s) have signed and dated the form, and if it's a joint return, at least one spouse has signed.

The software ensures that the signature of the taxpayer is present on Form 4506-T and that the date of signing is also recorded. In cases where the form is for a joint return, it verifies that at least one spouse's signature is included. The system checks for the presence of these signatures to confirm the form's validity and the authorization of the request. It also ensures that the date of the signature is recent and appropriate for the time of submission.

12

Validates that the taxpayer's phone number is provided in the designated space.

The software validates that a phone number for the taxpayer is included in the designated area on Form 4506-T. It checks the format of the phone number to ensure it adheres to standard conventions and is potentially reachable. This validation is crucial for enabling the IRS to contact the taxpayer if necessary. The system also ensures that the phone number field is not left blank, as this could delay the processing of the form.

13

Confirms that the title of the individual signing on behalf of a corporation, partnership, estate, or trust is entered.

The software confirms that when Form 4506-T is being submitted on behalf of an entity such as a corporation, partnership, estate, or trust, the title of the individual authorized to sign is clearly entered. This check is important to establish the legitimacy of the representative's authority to request information. The system ensures that the title field is not left empty and that it corresponds with the entity type specified on the form.

14

Verifies that the spouse has also signed and dated the form if applicable.

The software verifies that if Form 4506-T pertains to a joint return, the spouse has also signed and dated the form. This check is essential to ensure that both parties consent to the request for a transcript. The system looks for the presence of a second signature and date, confirming that both spouses have authorized the form when required.

15

Checks that the form is signed only after all applicable lines have been completed and the box in the signature area is checked to acknowledge authority.

The software checks that all necessary fields on Form 4506-T are completed before the form is signed. It ensures that the taxpayer has checked the box in the signature area to acknowledge their authority to request the transcript. This validation is crucial to prevent the submission of incomplete forms and to confirm that the taxpayer understands their responsibility in signing the document.

Common Mistakes in Completing 4506-T

It is crucial to enter the name exactly as it appears on the tax return to avoid processing delays. The IRS uses the name to verify identity and match it to the correct tax account. To prevent this mistake, double-check past tax documents for the precise name used, including any middle initials or suffixes. If there has been a legal name change since the last filing, attach the appropriate documentation to support the change.

The Social Security Number (SSN), Individual Taxpayer Identification Number (ITIN), or Employer Identification Number (EIN) must be accurate to ensure the IRS can locate the correct tax records. An incorrect number can lead to a rejection of the request. Before submitting Form 4506-T, verify the number by comparing it with official documents such as Social Security cards or previous tax filings. If the number has changed for any reason, include documentation to reflect this change.

When requesting a transcript for a joint tax return, it is necessary to include the spouse's name as it appeared on the joint return. This helps the IRS to verify the identity of both parties and provide the correct information. To avoid this error, review the joint tax return to confirm the spouse's name and include it on the form. If the spouse's name has changed, provide legal documentation of the name change.

For joint returns, both the primary and secondary taxpayer's SSNs or ITINs must be provided. This information is used to authenticate the request and access the correct tax records. Ensure that both numbers are included on the form and that they are accurate. Cross-reference with previous joint tax returns or other official documents to verify the numbers before submission.

The current address, including the apartment number if applicable, must be complete and accurate to ensure the delivery of the tax transcript. An incomplete or incorrect address can result in the transcript being sent to the wrong location. To prevent this, confirm the current address against a recent utility bill or official correspondence. If you have moved since the last tax filing, update the address with the IRS before requesting the transcript.

Failing to provide a previous address when it differs from the one on the last tax return can lead to processing delays or the IRS being unable to fulfill the request. It is crucial to include any previous addresses that may have been associated with past tax filings to ensure the correct transcripts are retrieved. Taxpayers should double-check their records and ensure that the address provided on Form 4506-T matches the one used on their last tax return. If there has been a change of address since the last filing, it must be noted in the appropriate section of the form.

Inputting a Social Security Number (SSN) instead of a customer file number in line 5 is a common error. The customer file number field is optional and is intended for the requester's use to help them match the transcript to the taxpayer. An SSN should not be entered in this field. To avoid this mistake, requesters should leave line 5 blank unless they have a specific customer file number that they use to identify the document. If a customer file number is used, it should be a number that is meaningful to the requester, such as an account or file identification number.

Choosing the incorrect tax form number in line 6 can result in the IRS providing a transcript for the wrong tax document, which can be a significant setback. It is essential to verify the specific tax form number for which the transcript is needed before completing the form. Taxpayers should refer to their tax records or consult with a tax professional if they are uncertain about the correct form number to request. Careful attention to the list of available forms and selecting the appropriate one will ensure the correct information is provided.

Neglecting to check the appropriate box for the type of transcript needed is a mistake that can lead to receiving the wrong type of tax information. There are several types of transcripts available, each serving a different purpose. Taxpayers should carefully read the descriptions of each transcript type and select the one that best fits their needs. It is important to understand the difference between a tax return transcript, tax account transcript, record of account, and wage and income transcript to make the correct selection.

Omitting to check the box for requesting W-2, 1099, and other income document information can result in not receiving all necessary tax documentation. If these documents are required, the requester must check the box in line 8 on Form 4506-T. This information is often needed for loan applications and for accurate tax preparation. To avoid this oversight, requesters should review the form thoroughly before submission and ensure that all necessary boxes are checked to receive all relevant income information.

Line 9 of Form 4506-T requires the requester to specify the form number of the tax return transcript they need. It is crucial to use the MM/DD/YYYY date format when filling in this section. Using different date formats can lead to processing delays or even rejection of the request. To avoid this mistake, double-check that the date is entered correctly and corresponds to the required format before submitting the form.

The taxpayer's signature is mandatory on Form 4506-T to validate the request. An absent or incorrect signature will result in the form being returned without the requested transcript. Ensure that the taxpayer signs the form in the designated signature area and that the signature matches the one on file with the IRS. If the taxpayer cannot sign, a valid power of attorney may be required.

A taxpayer's phone number is a critical piece of information on Form 4506-T that is often overlooked. Without it, the IRS may be unable to contact the taxpayer for any clarifications or issues, potentially delaying the processing of the request. To prevent this, the taxpayer should provide a current phone number where they can be readily reached during business hours.

When an authorized individual is requesting a transcript on behalf of an entity, it is mandatory to enter their title in the appropriate field on Form 4506-T. Neglecting to provide this information can lead to the IRS questioning the legitimacy of the request. Authorized individuals should ensure their title is clearly printed on the form to confirm their authority to request the information.

For joint tax return transcripts, both spouses must sign Form 4506-T if they filed a joint tax return and are still married at the time of the request. A missing spouse's signature can invalidate the request. To avoid this issue, both spouses should review the form together and ensure both signatures are provided before submission.

Submitting Form 4506-T after 120 days from the signature date invalidates the request, as the IRS considers the signature to be outdated. To avoid this, ensure that you send the form within the 120-day window after signing it. It is advisable to review the form for accuracy and completeness as soon as possible after filling it out, and to promptly mail or fax it to the appropriate IRS address or fax number. Keeping track of the signature date and setting a reminder can help ensure timely submission.

Signing Form 4506-T before all applicable lines are completed can lead to processing delays or the rejection of the form. It is important to thoroughly review the form instructions and fill out all required information before signing. Double-check that all relevant sections are filled out accurately and completely. Sign the form only after you have verified that all the information is correct and that no required fields have been left blank.

Failing to check the appropriate authority box in the signature area of Form 4506-T can result in the IRS not recognizing the authority of the individual to request the information. It is crucial to read the instructions regarding who has the authority to sign the form and to check the appropriate box that corresponds to the signer's authority. If you are signing on behalf of a business, organization, or other entity, ensure that you have the legal authority to do so and that the correct box is checked to reflect this.

Using an incorrect address or fax number for submission based on the state can lead to the form being sent to the wrong IRS office, causing delays. To prevent this, consult the latest IRS instructions for Form 4506-T to determine the correct address or fax number for your state. The IRS periodically updates these addresses and fax numbers, so it is important to use the most current information available. Always verify the correct submission details before sending the form to ensure it reaches the correct destination.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out 4506-T with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills 4506-t forms, ensuring each field is accurate.